In the last couple of years, global investment markets have experienced an explosion in the listings of an investment product called an exchange-traded fund (ETFs).

Undoubtedly, ETFs have been the most significant investment innovation over the last three decades, if not ever. There are over 2,600 listed in the U.S. alone. In South Africa, it is no different. There are currently more than 170 ETFs on the Johannesburg Stock Exchange (JSE) that offer investors exposure to various investment strategies. The proliferation of these types of securities means that investors can obtain exposure to an extensive range of investments that otherwise would have been difficult and expensive to construct on their own.With little effort and low cost, investors can use ETFs to invest across the following strategies:

- Asset Class (cash, bonds, property, equities)

- Index (Top 40, S&P 500)

- Region (Japan, USA)

- Sector (energy, technology)

- Fundamental Factor (dividends, growth, value, momentum, i.e. an ETF that invests in companies that have paid a dividend for 25 consecutive years)

- Theme (biotech, fintech, artificial intelligence)

- Leverage and Inverted (two or three times leverage, short positioning, i.e. an ETF that gives investors 3x the exposure of their investment, or an ETF that is structured to be profitable when markets decline.)

- Currency

The array of available ETFs can be overwhelming for investors, so we caution against the term passive investing that is often associated with ETFs. More recently, investors can now invest in active ETFs. With so many options, we prefer the term index tracking.

Two of the most well know ETFs in South Africa are the Satrix 40 ETF and Absa NewGold ETF. The Satrix 40 ETF tracks the performance of the JSE Top 40 Index, while the Absa NewGold ETF tracks the US$ performance of gold. With assets under management of $362bn, the SPDR S&P 500 ETF is the world’s biggest ETF.

What is fascinating is that many empirical studies have found that the average investor in an ETF underperforms the performance of that ETF. This is mainly due to investors’ behaviour of buying high and then selling low rather than being invested with a long-term orientation.

On a lighter note, every ETF has a specific investment ticker, and we are continually amused at the codes the ETF providers create. For instance:

MOO – invests in agricultural businesses

BOSS – invests in companies that are founder run

ROOF – invests in small-cap real estate businesses

PICK – invests in mining businesses

PAWZ – invests in companies that benefit from pet ownership

HACK – invests in companies that provide cyber security solutions

A list of other obvious amusing tickers where the underlying strategy is revealed: HEAL, PAVE, AWAY, HODL, IPAY, IBUY, KARS, KURE, SMOG, TAN.

How does an ETF differ from the more traditional unit trust investment?

ETFs and unit trusts provide exposure to various asset classes and specialist markets. They comprise baskets or pools of individual securities and are more diversified than single stocks or bonds. These types of investments offer investors a single point of entry to own a portfolio of securities constructed according to a particular strategy.

Traditionally, ETFs followed an index tracking strategy that exposed investors to a stock market index (like the JSE TOP 40) cost-effectively. The EFT would passively track the index to align returns with the index. Conversely, unit trusts are usually actively managed and aim to beat a benchmark based on a stock market index.

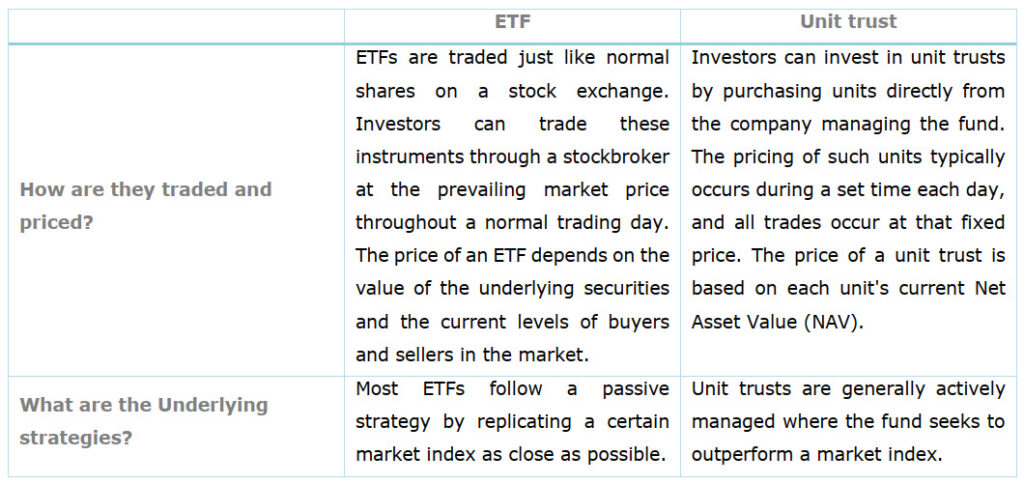

The table below explores the significant differences between ETFs and unit trusts.

In summary, the typical investor in an ETF would be looking at a cost-effective way to invest in a particular investment strategy. The goal is to earn the same return without under- or outperforming the underlying index.

An investor in a unit trust invests in a portfolio of securities following a specific strategy – to outperform the index in a particular sector. Investors will pay a higher asset management fee for that advantage.

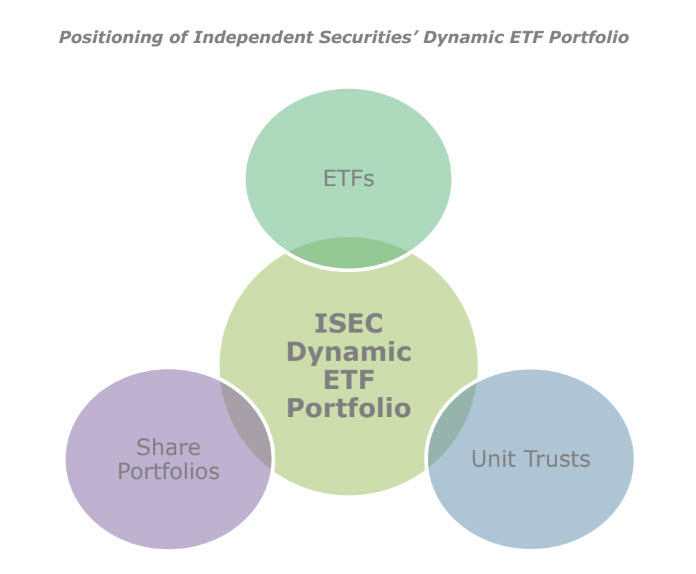

Dynamic ETF Portfolio from Independent Securities (ISEC).

Over the last six years, the investment team at ISEC have developed a strategy for investing exclusively in ETFs, which combines the benefits of investing in a traditional share portfolio and unit trust. ISEC’s approach involves dynamically managing a portfolio of ETFs. Besides selecting an ETF with an attractive investment strategy, we also consider aspects such as size, fees, credit risk, tracking error, and trading spread, amongst other things.

More specifically, the core portfolio consists of investments in global thematical ETFs that we believe will perform well over time. Additionally, the portfolio incorporates tactical shorter-term positions in themes, sectors, regions, or other factors that could add a return to the portfolio against current market conditions. The ISEC Dynamic ETF portfolio consists of 18 ETFs with diverse themes ranging from blockchain technologies to dividend compounding ETFs and various other strategies. Since its inception (January 2017), the model ISEC Dynamic ETF portfolio has materially outperformed the iShares MSCI World ETF.

Don’t hesitate to contact your portfolio manager at Independent Securities should you be interested in our ISEC Dynamic ETF portfolio and would like to receive more information.

Research Editor

Roelof Feenstra